Structured Cash Flows

Build the financial future you need with certainty using fixed, periodic income.

Our expert team can direct you to the right products to lock in today's higher interest environment with income for decades to come.

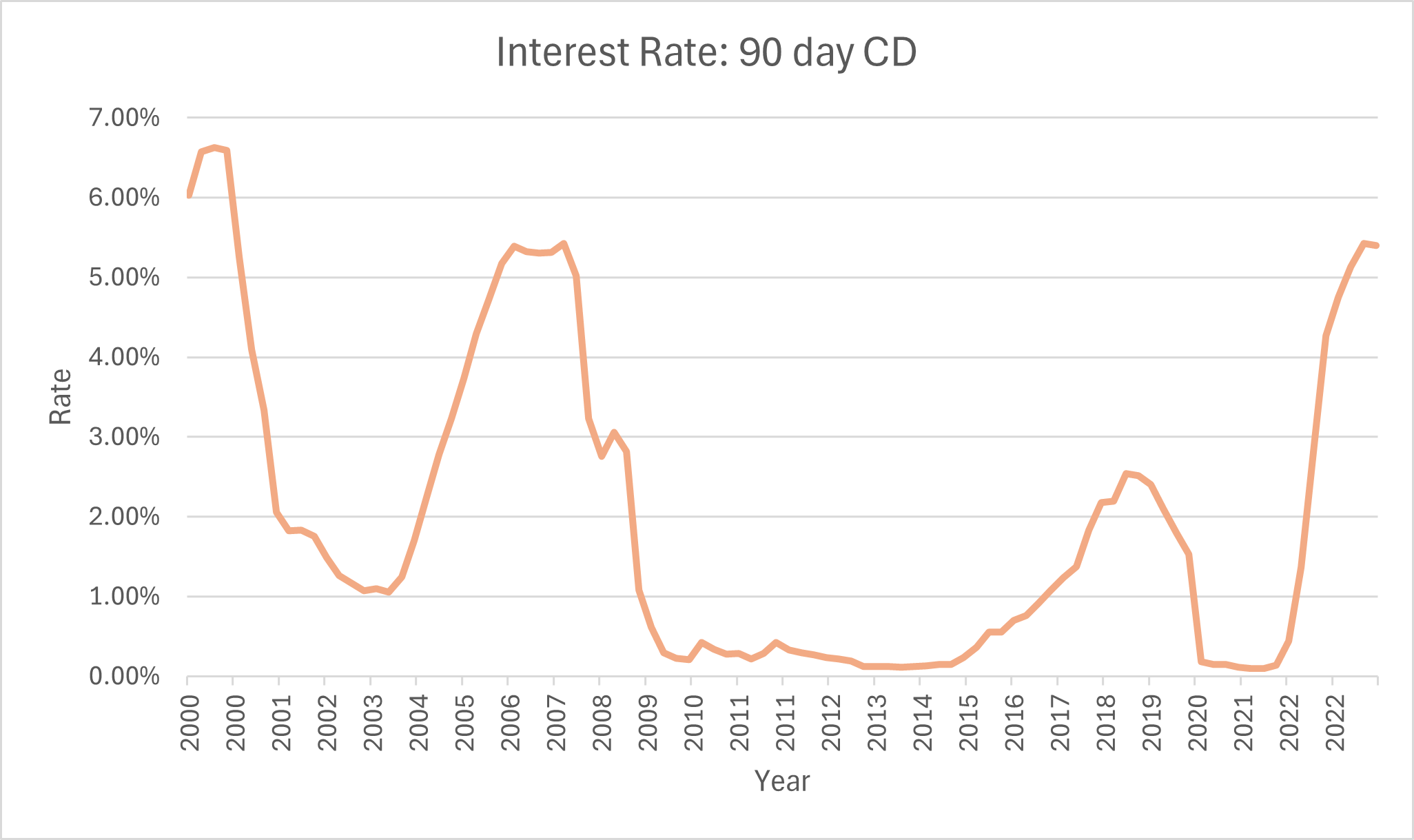

With today's current interest rate environment providing investors with some of the highest returns in the last 20 years, we are presented with an opportune moment to lock in these yields for the future. No one can perfectly predict where interest rates will go over the next few years, but historically these types of returns are short-lived.

Why buy fixed income?

Investors should consider buying fixed income payments for their stability and predictability. These investments offer reliable returns, making them a valuable component of a diversified portfolio. Particularly in uncertain economic times, fixed income payments provide a safeguard against market volatility, ensuring steady income streams and preserving capital.

Insulate from market volatility

Schedule future payments to match needs

Lock in favorable rates for decades to come

Why buy from Integrity?

Integrity Funding has sold and serviced millions of dollars worth of fixed income payments to our clients over the past 17 years. We specialize in structured settlement payments, allowing us to deliver above market returns on fixed income future cash flows that still hold the credit backing of A or better rated financial institutions. Our experience and knowledge in this field allows us to match clients with the cash flow that works best for their future needs or goals. Contact our team today to see how we might work together to ensure your financial future.

What is a Structured Settlement?

A structured settlement refers to a financial arrangement where periodic payments are made to an individual as compensation for a legal claim, typically resulting from a personal injury or accident. These payments are guaranteed and issued from an annuity from a variety of highly-rated insurance companies, providing a reliable stream of income over a predetermined period or for the individual's lifetime. Once sold in the secondary market, they allow investors to gain the security of a traditional annuity with enhanced, above market rates of return.

Structured settlements are attractive to fixed income investors because they offer steady and predictable cash flows, which can be valuable for portfolio diversification and managing risk. They provide a stable source of income without the variability of other investments, making them a dependable component of an income-focused investment strategy.